Merger and Acquisitions

Merger and Acquisitions

Maxalpha is your trusted partner in navigating the complex landscape of Mergers and Acquisitions (M&A). Our dedicated team of seasoned professionals specializes in providing comprehensive M&A services designed to guide businesses through every phase of the transaction lifecycle for buy side as well as sell side.

Buy Side Advisory

Our Buy Side Advisory services redefine the art of strategic acquisition. We specialize in guiding businesses through the intricacies of the buy-side transaction process, offering comprehensive solutions that align with your growth objectives and maximize value creation

.Choose Maxalpha for Buy Side Advisory services that go beyond conventional transactions. We are dedicated to forging successful acquisitions that enhance your strategic position, drive growth, and create lasting value for your organization

SELL SIDE ADVISORY

Our Sell Side Advisory services redefine the art of strategic divestiture. We specialize in guiding businesses through the process of selling assets, divisions, or the entire company. Our comprehensive Sell Side Advisory services are designed to optimize value, maximize deal structuring, and seamlessly navigate the complexities of the divestiture process.

Choose Maxalpha for Sell Side Advisory services that go beyond traditional divestiture. We are committed to maximizing value, minimizing complexities, and facilitating successful transactions that align with the strategic goals of our clients.

Buy Side Advisory

Our Buy Side Advisory services redefine the art of strategic acquisition. We specialize in guiding businesses through the intricacies of the buy-side transaction process, offering comprehensive solutions that align with your growth objectives and maximize value creation.

Choose Maxalpha for Buy Side Advisory services that go beyond conventional transactions. We are dedicated to forging successful acquisitions that enhance your strategic position, drive growth, and create lasting value for your organization

Sell Side Advisory

Our Sell Side Advisory services redefine the art of strategic divestiture. We specialize in guiding businesses through the process of selling assets, divisions, or the entire company. Our comprehensive Sell Side Advisory services are designed to optimize value, maximize deal structuring, and seamlessly navigate the complexities of the divestiture process.

Choose Maxalpha for Sell Side Advisory services that go beyond traditional divestiture. We are committed to maximizing value, minimizing complexities, and facilitating successful transactions that align with the strategic goals of our clients.

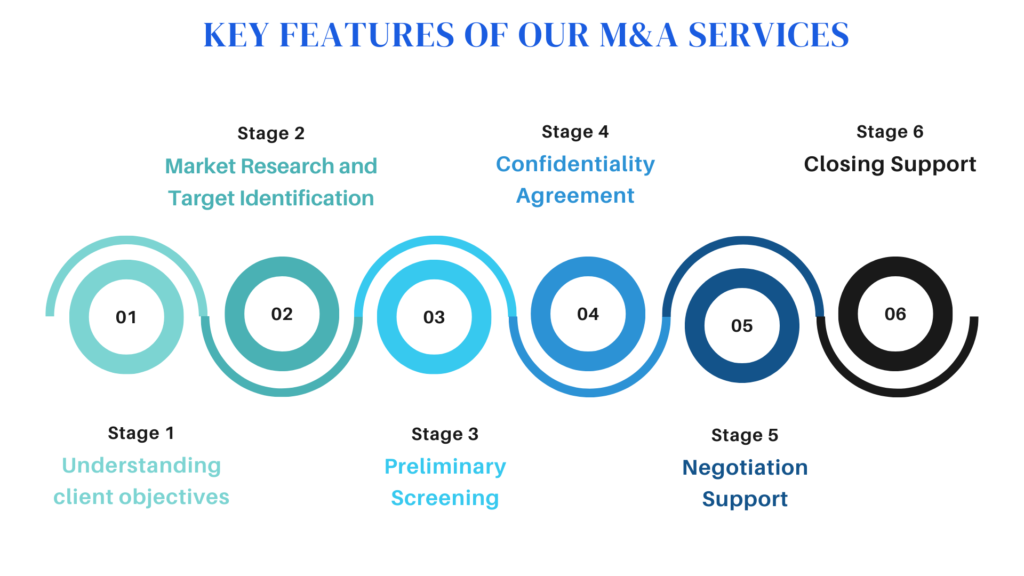

Key Highlights of Our M&A Services:

Why us?

Seasoned Experts

Our M&A advisors are highly experienced former CEOs and Domain Experts who bring a wealth of knowledge and insights to every engagement. They are backed by a team of industry researchers, writers, and valuators, ensuring that you receive top-notch expertise and guidance throughout the process.

Extensive Global Reach

With our offices and associates strategically located worldwide, we have a deep understanding of the international market. Whether you are looking to expand your business within your region or venture into new territories, MaxAlpha's global network enables us to navigate complexities and seize opportunities across borders.

Proven Track Record

MaxAlpha has a proven track record of delivering successful M&A transactions across various industries and geographies. Our clients trust us for our ability to navigate complex deals, negotiate favorable terms, and drive value creation. When you choose MaxAlpha, you choose a partner with a history of generating exceptional results.

Investor

Meet

Periodically, MaxAlpha organizes the exclusive 'Investor Meet' platform, where investors and those seeking investments converge to explore compelling business opportunities. As a client, you gain access to this unique platform, connecting you with potential investors and fostering valuable connections.